Stock market investing is about making confident, well-informed judgments supported by thorough research, not about generating quick money. Learning the stock market fundamentals is one of the finest methods to achieve this. What they are, why they are important, and how to use them to create long-term wealth are all explained in this blog post.

Knowing the fundamentals will help you distinguish between safe and dangerous investments, regardless of your level of experience.

Table of Contents

📊 What Are Stock Market Fundamentals?

Stock market fundamentals are the underlying financial and economic variables that indicate a company’s true value. This includes:

Revenue

Profit margins

Earnings per share (EPS)

Return on equity (ROE)

Debt levels

Industry position

👉 In simple terms, fundamentals help you figure out

“Is this company really worth investing in, or is it just riding hype?”

🧾 Key Elements of Fundamental Analysis

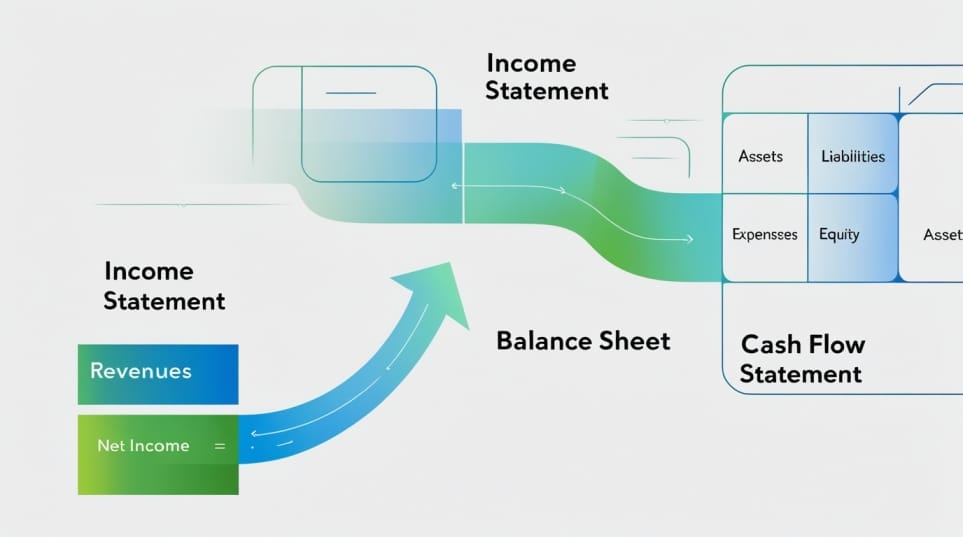

1. Income Statement.

- Displays revenues, costs, and net profits.

- Consider it a report card for profitability.

2. Balance Sheet

- Includes assets, liabilities, and shareholder equity.

- Shows how financially solid a company is.

3. Cash Flow Statement.

- Monitors the movement of cash in and out.

- Cash is king—profits are great, but cash pays the bills.

4. Earnings per Share (EPS)

- Net income divided by outstanding shares.

- A higher EPS frequently indicates greater profitability.

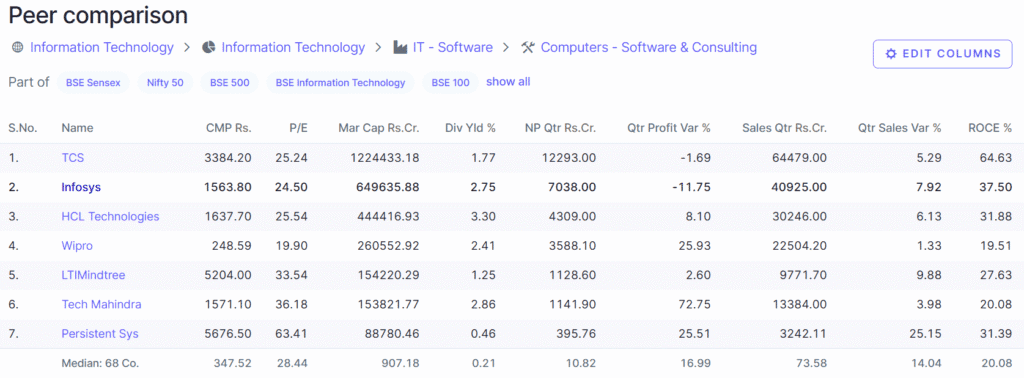

5. Price to Earnings (P/E) Ratio

- Share price divided by earnings per share (EPS).

- Helps compare company value to peers.

💼 Why Fundamentals Matter in Long-Term Investing

Short-term traders may follow trends or news. Long-term investors, however, prioritize value. Here’s why.

📊 Minimizes Risk: You know what you’re buying.

📈 Builds Wealth: Invest in businesses that grow profits over time.

💡 Supports Patience: Fundamental strength gives confidence to hold during market dips.

📊 Case Study Example:

In 2008, Amazon had a solid balance sheet and strong cash flow. Despite short-term stock crashes, long-term investors who understood the fundamentals saw 10x returns by 2020.

📈 Real-World Example: Analyzing a Stock Fundamentally

Company: Infosys Ltd

| Metric | Value | Why It Matters |

|---|---|---|

| Revenue Growth (YoY) | 14.7% | Shows increasing demand |

| Net Profit Margin | 21.2% | Indicates strong profitability |

| ROE | 30.1% | Efficient use of shareholder funds |

| Debt-to-Equity Ratio | 0.09 | Very low debt risk |

| P/E Ratio | 27.5 | Slightly overvalued, but growing |

🧠 Common Mistakes in Fundamental Analysis

Focusing only on one metric (like P/E).

Ignoring industry differences.

Not reading the management discussion.

Overlooking red flags in the balance sheet.

Buying based on past performance rather than future outlook.

🔍 Always look at the full picture before investing.

🛠️ Tools and Resources to Analyze Fundamentals

✅ Screener.in – Free financial data and screeners.

✅ Tickertape – Visual analytics and financial ratios.

✅ Yahoo Finance – Historical performance and comparison.

✅ Morningstar – Deep company reports and analysis.

🧓 Expert Opinions on Using Fundamentals

“Investing is most intelligent when it is most businesslike.”

Benjamin Graham, Father of Value Investing

“Time is your friend; impulse is your enemy. Take advantage of compound interest and don’t be captivated by the siren song of the market.”

Warren Buffett

These legends based their wealth on fundamental concepts. So can you.

🧭 Conclusion

Understanding stock market fundamentals is not an option; it is necessary for long-term wealth. While market prices fluctuate on a daily basis, good fundamentals serve as a compass, directing your investing decisions toward actual value rather than noise.

Whether you’re researching Infosys, HDFC Bank, or a small-cap startup, the approach is the same: focus on the business rather than the stock.

🔗 External Resources

🛡️ Disclaimer

This blog post is for educational purposes only and does not constitute financial advice. Please consult with a SEBI-registered financial advisor before making any investment decisions.

1. What are the basics of stock market fundamentals?

Financial metrics such as earnings, revenue, and debt are used to determine a company’s true value on the stock market.

2. Can beginners learn fundamental analysis?

Absolutely! When broken down into phases, the income statement, balance sheet, cash flow, and valuation ratios become more manageable.

3. Is fundamental analysis better than technical analysis?

Yes, for long-term investment purposes. Technical analysis is suitable for short-term trading, whereas fundamentals reveal a company’s true health.

4. How often should I check fundamentals?

At least once a quarter, or when big corporate events (mergers, leadership changes) occur.