Are you keeping an eye on the IPOs of 2025? If so, you might want to keep an eye on Mayasheel Ventures Ltd. IPOs are very important for making money and finding early investment opportunities. Knowing the ins and outs of each one can give you an edge over the competition.

Table of Contents

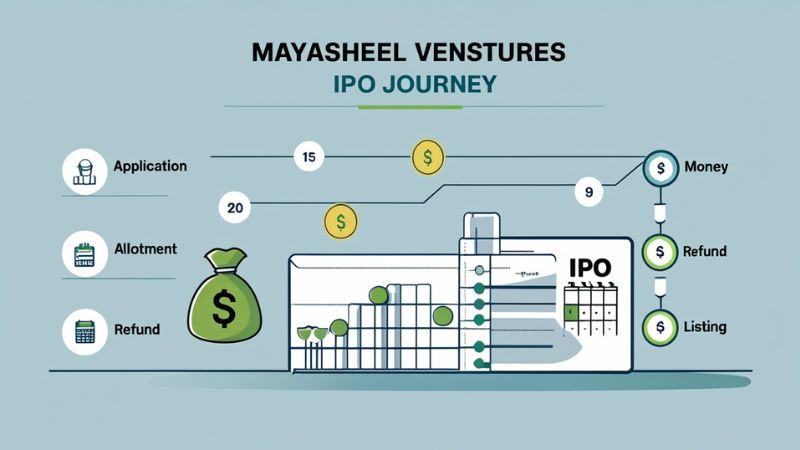

We go into great detail in this blog post about everything you need to know about the Mayasheel Ventures IPO, including the Grey Market Premium (GMP), lot size, issue date, price band, and more. This guide gives clear information, expert context, and actionable takeaways for both new investors who want to get into the IPO market and experienced traders who want to look at trends before a listing.

Let’s explain this IPO in simple terms that everyone can understand so you can decide if it’s a good fit for your portfolio.

🏢 About Mayasheel Ventures Ltd

🧱 What Does the Company Do?

Mayasheel Ventures Limited, formerly a partnership firm, is engaged in constructing roads, highways, flyovers, and bridges for government entities like NHIDCL. It also undertakes electrical works, including powerhouses and transmission lines, and is exploring further opportunities in this segment.

🌍 Global Presence & Vision

It wants to grow its business around the world by using new ideas and operations that can be scaled up to meet demand outside of India.

📊 IPO Overview: Key Details, IPO Date, Lot Size & Price Band

| Parameter | Details |

|---|---|

| IPO Name | Mayasheel Ventures Ltd |

| IPO Type | SME IPO (Book Building) |

| Price Band | ₹44.00 – ₹47.00 |

| Lot Size | 3,000 Shares |

| Issue Size | ₹27.28 Crores |

| Total Shares Offered | 58,05,000 Shares |

| Retail Minimum Investment | ₹1,32,000 (1 Lot) |

| Retail Max Investment | ₹1,41,000 (1 Lot) |

| HNI Minimum Investment | ₹2,64,000 (2 Lots) |

| HNI Max Investment | ₹4,23,000 (3 Lots) |

| Retail/HNI Discount | ₹0.00 |

| Pre-Apply Status | Open |

| Event | Date & Time |

|---|---|

| IPO Open Date | 20 June 2025 (10:00 AM) |

| IPO Close Date | 24 June 2025 (5:00 PM) |

| Allotment Finalisation | 25 June 2025 |

| Refund Initiation | 26 June 2025 |

| Shares Credited to Demat | 26 June 2025 |

| Listing Date | 27 June 2025 |

📝 Note: Confirm official details via SEBI or the company prospectus.

💸 GMP (Grey Market Premium): What’s the Buzz?

📈 What is GMP?

GMP shows how investors feel and how much they want the IPO before it goes public. In the gray market, shares are traded at an unofficial premium.

🗞️ Latest GMP for Mayasheel Ventures

The Mayasheel Ventures IPO GMP hit a high of ₹6 on June 18 and a low of ₹5 on June 16.

💰 Company Financials & Valuation

📉 Past Performance Snapshot

Amount in ₹ Crore

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 99.10 | 92.56 | 79.03 |

| Revenue | 172.05 | 131.14 | 127.10 |

| Profit After Tax | 11.33 | 6.51 | 4.75 |

| Net Worth | 28.84 | 24.09 | 18.06 |

| Reserves and Surplus | 12.59 | 0.00 | 0.00 |

| Total Borrowing | 34.06 | 35.05 | 33.23 |

📊 Valuation Metrics

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 6.98 | 5.14 |

| P/E (x) | 6.74 | 9.14 |

Note:

The Pre IPO EPS is based on the shareholding before the issue date and the most recent fiscal year earnings as of March 31, 2025, which are available in the RHP.

The Post Issue EPS is based on the Post Issue shareholding and the annualized FY earnings as of March 31, 2025, which can be found in RHP.

⚖️ Should You Invest? Risk vs Reward

✅ Pros

- Growing sector 📈

- Diversified revenue base 🌍

- Positive GMP signal 💹

⚠️ Risks

- SME IPO volatility 🌀

- Sector dependency ⚙️

- Competitive landscape 🔍

📝 How to Apply for the IPO

Step-by-step guide for retail and global investors:

- Open a demat account.

Free Demat Account Links:

2. Use UPI or net banking via ASBA

3. Apply through Zerodha, Groww, etc.

4. Track application on registrar site

🧾 Final Thoughts

The IPO for Mayasheel Ventures Ltd could be a good chance for investors who want to get in on the ground floor of a business that might grow. But just like with any other small business IPO, you should do your research and think about how much risk you can handle.

⚠️ Disclaimer

This blog post is for informational purposes only. It does not constitute investment advice or a recommendation. Readers are advised to consult a financial advisor before making any investment decisions.

What Is Inflation and How Does It Affect Your Money?

What Is Market Capitalization? A Simple Guide for Investors

Top 5 Discount Brokerages for Smart Trading in 2025

July 2025 Stock Market Holidays: Full List & Trading Tips for Investors

📈 Upcoming IPOs in July 2025

Candlestick Pattern Basics: A Beginner’s Guide

1. What is the issue size of Mayasheel Ventures Ltd IPO?

The issue size of the Mayasheel Ventures Ltd IPO is ₹27.28 Cr

2. What is 'pre-apply' for Mayasheel Ventures Ltd IPO?

Pre-apply will allow you to apply for the Mayasheel Ventures Ltd IPO before the IPO starts. Pre-apply usually starts two days before the IPO opens but may start even before that.

3. If I pre-apply for Mayasheel Ventures Ltd IPO, when will my order get placed?

Your order will be placed on the exchange as soon as the Mayasheel Ventures Ltd IPO bidding starts. You will receive a UPI request within 24 hours after the bidding period opens.

4. When will I know if my Mayasheel Ventures Ltd IPO order is placed?

Exchange will notify you with SMS when your Mayasheel Ventures Ltd IPO order is placed.

5. What are the open and close dates of the Mayasheel Ventures Ltd IPO?

Mayasheel Ventures Ltd IPO will be open between 20/06/25 and 24/06/25.

6. What is the lot size and minimum investment of the Mayasheel Ventures Ltd IPO?

Mayasheel Ventures Ltd IPO lot size is 3000 Shares and minimum investment is ₹1,32,000.00 / 1 Lot

7. What is the allotment date for the Mayasheel Ventures Ltd IPO?

Mayasheel Ventures Ltd IPO allotment date is 25/06/25

For Mayasheel Ventures Ltd IPO allotment status check, you can also visit the website of the registrar of the IPO.

Angel One doesn’t have any involvement in the allotment chances of application.