🧭 Why ETFs Matter Today

Investors want smarter, easier, and more varied ways to grow their money in today’s fast-paced financial world. Exchange-Traded Funds, or ETFs, are what you need.

Table of Contents

ETFs are a great way to diversify your portfolio, whether you’re just starting out in the market or have been trading for a while. This guide tells you everything you need to know about ETFs in simple terms, with real-life examples, useful tips, and expert opinions.

🧺 What Is an ETF?

You can buy and sell an ETF (Exchange-Traded Fund) on a stock exchange, just like you can with individual stocks. An ETF is a basket of securities, such as stocks, bonds, or commodities.

✅ In Simple Terms:

ETFs are like ready-made meals for investors: they are easy to use, balanced, and good for everyone.

📘 Example:

The SPDR S&P 500 ETF (SPY) follows the 500 biggest companies in the U.S. You own a piece of all 500 companies when you buy 1 share of SPY.

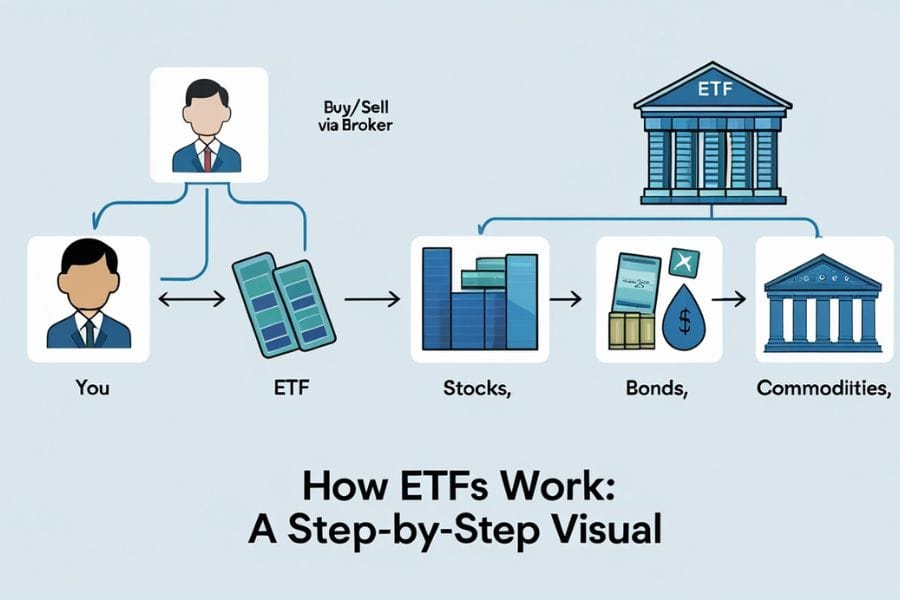

⚙️ How Do ETFs Work?

ETFs follow an index or asset to work. Fund managers take money from investors and buy assets that are similar to that index.

Key characteristics:

- Traded like stocks on the market

- Price fluctuates throughout the day

- Lower expense ratios than mutual funds

- High liquidity for most popular ETFs

You can buy and sell ETFs during market hours on a brokerage platform.

🔍 Different Types of ETFs Explained

Here are the main types of ETFs available globally:

| Type | Focus Area | Example |

|---|---|---|

| Index ETFs | Track market indexes | S&P 500 ETF (SPY) |

| Bond ETFs | Invest in government/corporate debt | iShares Core U.S. Bond ETF |

| Commodity ETFs | Track assets like gold or oil | SPDR Gold Shares (GLD) |

| Sector ETFs | Focus on industries like tech | Technology Select Sector (XLK) |

| International ETFs | Invest outside home country | Vanguard FTSE All-World ex-US (VEU) |

| Thematic ETFs | Focus on trends (e.g., clean energy, AI) | Global X Robotics & AI ETF (BOTZ) |

📊 ETFs vs Mutual Funds: Key Differences

| Criteria | ETFs | Direct Mutual Funds |

|---|---|---|

| NAV Availability | In real-time | Everyday |

| Intraday Trading | Possible | Not possible |

| How To Invest | Via Stock Market or AMC | Via AMC |

| Expense Ratio | Low | High |

| Charges Upon Exit | Nil | Exit Loads, if any |

| Where To Redeem | Stock Market or AMC | AMC |

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading Style | Intraday trading | End-of-day NAV pricing |

| Expense Ratio | Generally lower | Often higher |

| Minimum Investment | Can be as low as 1 share | May require a lump sum |

| Transparency | Daily holdings disclosed | Monthly/quarterly reports |

| Tax Efficiency | More tax-efficient structure | Less tax efficient |

✅ Conclusion: ETFs are more flexible, especially for new investors and those who want to save money.

✅❌ Pros and Cons of ETFs

Pros:

- ✅ Simple to diversify

- ✅ Low cost

- ✅ Cash flow

- ✅ Transparency

- ✅ Available through brokerage apps

Cons:

- ❌ Index ETFs may have stocks that don’t do well.

- ❌ Trading often can cost you money

- ❌Leveraged and inverse ETFs can be risky for beginners.

🪜 How to Invest in ETFs: Step-by-Step Guide

- 📈 Pick a trustworthy brokerage, like Zerodha, Fidelity, or Vanguard.

- 🔎 Look into different ETFs based on your goals, location, and sector.

- 💰 Set your budget and how much risk you’re willing to take

- 🛒Buy ETF shares the same way you would buy stocks.

- 🔄 Keep an eye on performance and rebalance if necessary

💡 Tip: Use low-cost index ETFs to build your main portfolio.

💡 Real-World Example: Using ETFs to Build Wealth

👤 Case Study – Maria, 28, from Spain, began investing $200 a month into the Vanguard Total World Stock ETF (VT). Her portfolio grew to over $15,000 in five years, thanks to average annual returns of about 8%. This was all from ETFs.

📌Lesson: Long-term wealth comes from being consistent and using ETFs to diversify.

🌍 Expert Insight: Why ETFs Are Gaining Popularity

Morningstar says that by 2024, global ETF assets had grown to over $12 trillion. New ETFs were created to focus on emerging markets, AI, sustainability, and other areas.

📣 Expert Quote:

“ETFs are democratizing investing. They give everyday investors access to markets once limited to institutions.”

Sarah Jennings, CFA, ETF Strategist

🔗 External Links

Also Read: Mastering Stock Market Fundamentals for Long-Term Wealth

🤔 Conclusion: Should You Invest Money into ETFs?

ETFs are a smart place to start if you want to invest in a simple, cheap, and globally diversified way. They are a solid base for any investment portfolio because they offer balance, flexibility, and long-term potential.

📢Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always consult with a certified financial advisor before making investment decisions.

🙋 Frequently Asked Questions (FAQs)

1: Are ETFs a good choice for people who are just starting out?

Yes! They’re easy to understand, cheap, and come in a variety of types, making them a great way to start investing.

2: Is it possible to lose money in ETFs?

Yes, ETFs are risky, just like all investments. Returns can be affected by market downturns.

3: What is the best way to choose an ETF?

Pay attention to low expense ratios, good past performance, and clear investment goals.

4: Do you have to pay taxes on ETFs?

Yes, depending on where you live and what kind of ETF you have, you may have to pay capital gains or dividend taxes.

5: What is the difference between a stock and an ETF?

A stock is a share in a single company, while an ETF holds many assets.