In the realm of investments, development rules everything. But how can you regularly track it across time? That is where CAGR—Compound Annual Growth Rate—fits. CAGR provides a clear, consistent approach for both new investors assessing a mutual fund and experienced traders examining portfolio performance to know how your investment has developed yearly over a period.

We will dissect CAGR in plain English, show you how to compute it, when to apply it, and how it stacks against other growth measures in this all-inclusive guide. This post will help you decode the numbers and make better decisions if you have ever been perplexed by returns that appear good but feel wrong.

Table of Contents

🤔 What Is CAGR?

Assuming profits are reinvested, CAGR—or compound annual growth rate—measures the average annual return of an investment over a given period. It flattens volatility and presents a better view of long-term performance.

“Regardless of how fast or slow you went at various points, “CAGR is like the average speed you need to travel to cover a distance in a specific time.”

Unlike absolute return, which just indicates the overall increase, this is a consistent method of gauging development.

📈 Why Is CAGR Important for Investors?

Consistency: clarifies yearly investment performance.

Comparability lets one compare several investments apples-to- apples.

Forecasting helps to project future performance depending on past patterns.

Clarity helps performance evaluation, particularly for long-term objectives like retirement.

🔗Related: Learning Stock Market Fundamentals for Future Wealth

📊 How to Calculate CAGR: The Formula

CAGR Formula:

CAGR = [(Ending Value / Beginning Value) ^ (1 / No. of Years)] - 1

Example:

If you invested $10,000 in 2018 and it’s worth $16,105 in 2023:

CAGR = [(16,105 / 10,000) ^ (1/5)] - 1 = 10%

So, your investment grew at 10% annually.

📝 Real-World Examples of CAGR

- Stock A: From $100 to $161 over 5 years → CAGR = 10%

- Mutual Fund B: NAV grew from ₹50 to ₹75 in 3 years → CAGR ≈ 14.47%

- Portfolio Growth: You can use CAGR to track your portfolio performance across different instruments.

💰 CAGR vs Absolute Returns: Key Differences

| Feature | CAGR | Absolute Return |

|---|---|---|

| Time Considered | Yes | No |

| Shows Annual Rate | Yes | No |

| Useful for | Long-Term Growth Tracking | Gain/Loss |

| Calculation | Slightly complex | Simple |

✅ Use CAGR to look at things over more than one year ❌ Long-term comparisons should avoid depending just on absolute returns.

🌟 When to Use CAGR (and When Not To)

When to Use CAGR

- Looking at mutual funds or stocks over several years

- Checking how well the portfolio is doing

- Predicting growth

Don’t use CAGR when:

- Annual returns are very volatile.

- How to measure short-term investments

- We need to see how things are doing year after year.

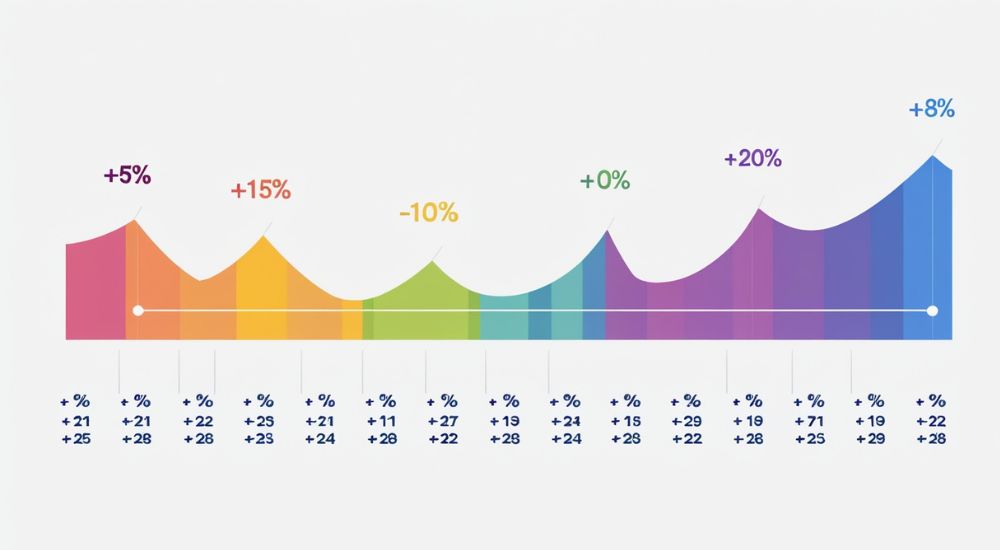

📚 How CAGR Helps in Comparing Investments

Think of two mutual funds:

Fund A: 6%, 8%, and 10% returns

Fund B: 2%, 12%, and 6% returns

It’s hard to tell which is better without CAGR.

CAGR gives you a fair measure by smoothing out the highs and lows. It shows who really did better over time, no matter how volatile things were.

Related: 10 Types of Stocks You Should Know About If You Want to Be a Smart Investor

🧑🎓 Actionable Takeaways for Smart Investors

Always use CAGR to look at long-term investments. Don’t just look at absolute returns. Along with CAGR, look at other metrics like risk, standard deviation, and alpha.

✅ Keep a journal of your investments and check the CAGR every year.

🔗 Related: A Beginner’s Guide to How to Invest in Stocks in 10 Easy Steps

🏆 Conclusion

CAGR is more than just a number; it’s a useful tool that helps investors understand how well something will do over time. It helps you cut through the noise of a volatile market and make meaningful comparisons between investments. Understanding CAGR is important for making smart investments, whether you’re keeping an eye on your own growth or comparing mutual funds.

For the best results, use it wisely and with qualitative research and risk assessment.

🔒 Disclaimer: This blog post is for educational purposes only. It does not constitute financial advice. Always consult a registered investment advisor before making investment decisions.

❓FAQs

1. What is a good CAGR for investment?

epending on the type of asset, a CAGR of 10–15% over the long term is good.

2. Can CAGR be negative?

Yes, if the value of the investment goes down over time.

3. Is CAGR used in mutual fund comparisons?

Of course. One of the most important things investors look at when comparing fund performance is this.

4. How often should I calculate CAGR?

Once a year is the best way to keep track of long-term goals.

5. Is CAGR affected by market volatility?

It makes things less volatile, but it doesn’t show changes from year to year.